Carmel Redevelopment Commission Director Henry Mestetsky often talks about how projects the city completes in conjunction with private developers lead to higher assessed values per acre and thus increased tax revenue for the city. As a result, this reduces the percentage of the tax burden on Carmel residential property owners.

Now, he has a tool to show it.

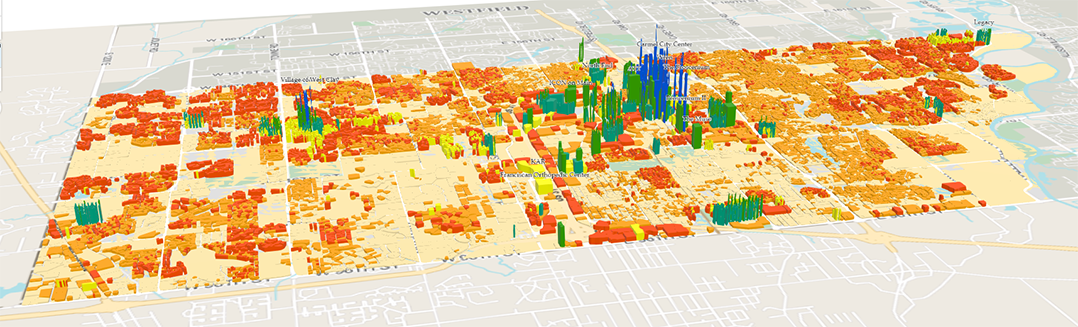

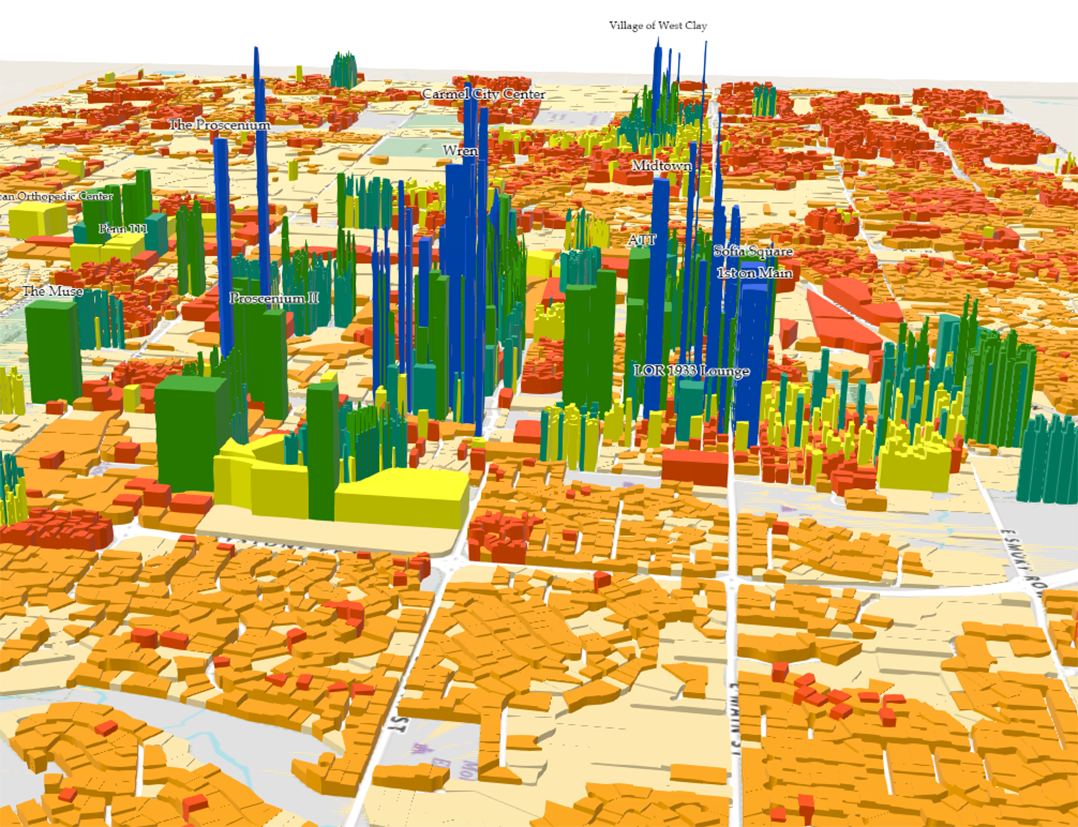

At the March 4 Carmel City Council meeting, Mestetsky unveiled a GIS map built by Shane Burnham, an employee in the city’s engineering department, that shows the assessed value per acre throughout the city. Most of the tallest bars (representing the highest assessed values per acre – not building heights) surround the city’s central core, which includes Midtown and much of the Arts & Design District, two of the areas in Carmel most transformed by redevelopment in recent years.

Throughout the map, the highest totals generally line up with redeveloped areas where the CRC has used tax increment financing to incentive mixed-use projects, often by paying for parking garages or other infrastructure improvements. TIF allows developers to capture increased tax revenues generated in an area because of redevelopment to pay for certain aspects of the improvements. TIF areas expire after a predetermined amount of time, after which previously captured taxes go to the city.

“(Development along) US 31 is what powered our city for the last 30 years from an economic development standpoint,” Mestetsky said. “We are using tax increment financing to build up a central core with so much assessed value that our city is going to be strong for the next 100 years.”

Other areas of the city with higher assessed values per acre include The Village of WestClay and the Legacy area in northeast Carmel. But they don’t come near the totals generated in the central core, where many property values are greater than $18.9 million per acre.

“Redevelopment is not ever going to go in the east side or the west side. It’s going to stay in the core,” Mestetsky said. “But as (we’re) doing projects that increase walkability and desirability, for those of us that own homes in the city of Carmel, we can be secure knowing that our taxes are just going to fall because we’re going to have more and more large projects assessed as crazy amounts per acre that are going to hit the city’s tax rolls as these TIF areas expire.”

The map corresponds to the amount of property taxes collected by the city, but Mestetsky said he expects a map showing income taxes collected by area would look similar.

“Large apartment buildings being filled with people who make on average $150,000 a year,” he said. “That’s a lot of property taxes and income taxes, all in the core being paid because of these new projects.”

The GIS map of assessed values per acre is not yet accessible to the public but may be in the future, Mestetsky said.